Two weeks ago, traders assigned a 60% probability to a FED emergency rate cut, potentially up to 75 basis points.

What was the “emergency” that required such a swift and powerful action from the FED two weeks ago? If your answer is “Japan,” then why should the FED cut rates and print money on behalf of the BOJ?

Why would a FED emergency rate cut two weeks ago have been the equivalent of throwing gasoline on the Japanese wildfire? Because decreasing the rates differential in the short end of the yield curve, the one with the greatest impact on FX rates, between the US and Japan would have strengthened the JPY even more against the USD, increasing the volumes of JPY carry trade positions forced to be unwound.

What did the FED do instead? It clearly coordinated with the BOJ to devalue the JPY to take the foot off JPY carry traders’ necks. How did they do it? Check out what happened to the EUR that, in the past 2 weeks, counterintuitively STRENGTHENED against both USD and JPY.

How could this be achieved? On one side, the US Treasury and the FED used the “buy back” program to bring down the yields in the long term of the curve while financing the purchases by issuing T-Bills and shorter maturity treasuries, ultimately decreasing the differential between EUR and USD rates. This wasn’t enough though; at the same time, the BOJ kept purchasing longer-dated JGBs, lowering those yields too. So, while the rates differential between USD and JPY curves remained roughly stable, it shrunk between EUR and USD while contemporarily widening between EUR and JPY. The combined effect of what I described is to trigger a bid for EUR since Eurozone government bonds were appreciating in relative terms against both those of the US and Japan.

Of course, what I described is a temporary fix and it has already exhausted itself. Why? Because if the DXY depreciates further, the FED will trigger a flare-up in inflation again due to a natural increase in the costs of all goods and commodities the US imports. On the other side, if the EUR keeps appreciating, that will have a significant impact on the export-oriented Eurozone economies that will eventually see a further slowdown of their GDP due to a decrease in exports (their goods will be more expensive compared to competitors like China).

As a matter of fact, as you can see in the DXY chart below, the previous time the FED “intervened” to help the BOJ (and when the market was dreaming about 6 rate cuts to be delivered in 2024), it was forced to stop and U-turn its narrative exactly where we are right now.

To all those who advocate rate cuts because those will benefit the economy, I dare to ask where exactly the economy will benefit in the current situation. A rate cut will not only risk triggering a resumption of forced JPY carry trades unwind, eventually putting stocks back on the brink of crashing before forced deleveraging, but will clearly reignite inflation in a country already dealing with a cost of living more and more unaffordable for a larger and larger portion of the population.

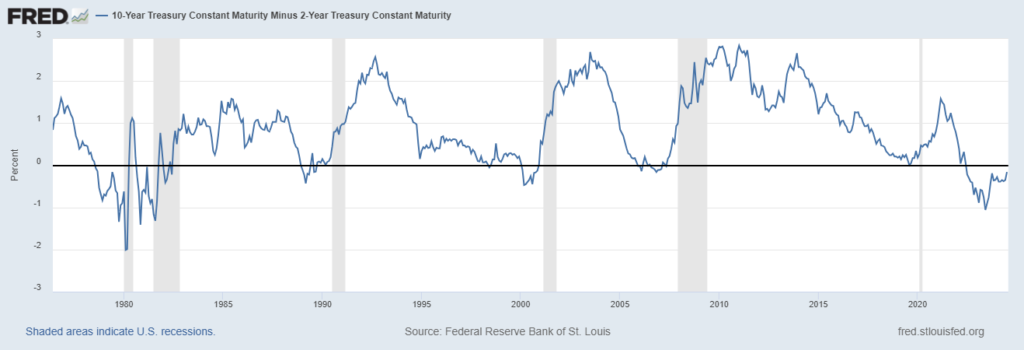

As if what I described wasn’t enough already, if the FED cuts rates, there is the ultimate risk of triggering an inversion of the US yield curve back to upward sloping.

Jerome Burns knows very well the moment the US Treasuries yield curve flips back to be upward sloping (as it should be in a world not heavily manipulated by central banks) it’s game over for stocks (“An inverted yield curve: why investors are watching closely“) since as you can see from the chart below the bubble always pops shortly after. Sorry, but this time, it won’t be different.

IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS

Ah, by the way, many other Central Banks like the #ECB have been doing similar things for years allowing banks to borrow from them at a rate and then lend the very same money back to Central Banks at a higher rate resulting in a “risk free” gain ultimately goosing banks bottom… https://t.co/T4GzOtV8zl

— JustDario 🏊♂️ (@DarioCpx) August 19, 2024

#NORINCHUKINBANK #CHAOS CAN TRIGGER AT ANY MOMENT - JustDario https://t.co/lxvZcgKQKb #Japan

— Guillermo Ruiz Zapatero (@ruiz_zapatero) August 20, 2024

No comments:

Post a Comment