HOW COULD JAPAN RECOVER SO FAST FROM THE WORST CRASH SINCE 1987? THANKS TO ITS GPIF “ANGEL” - JustDario: No person can pretend to know everything; it is simply not humanly possible. If anyone claims to do so, more often than not, they actually know little in reality. Personally, I use an investigative approach in everything I do, most of all to fill the gaps in my ignorance. This...

Sometimes, like today, I receive one of those comments that might easily

get lost in the ocean of social media, but that in reality deserves

much bigger attention since there is great value in it. This is the

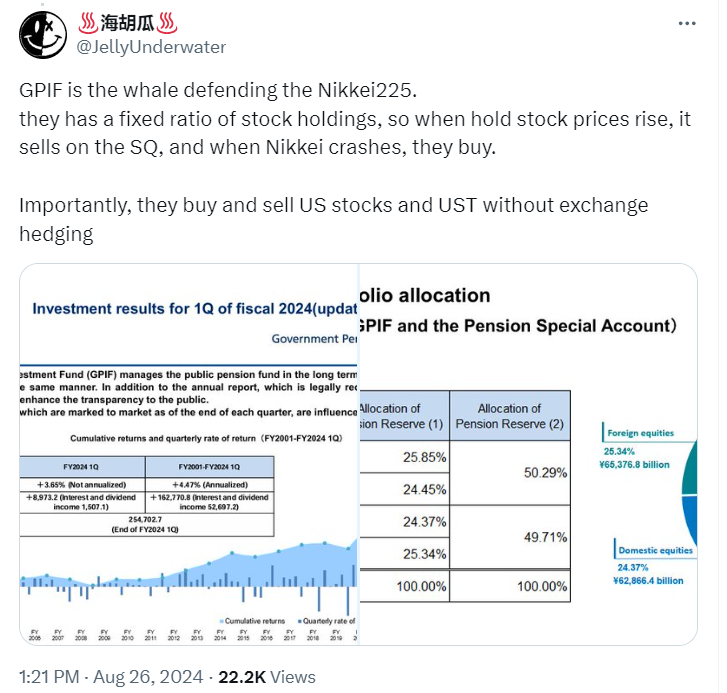

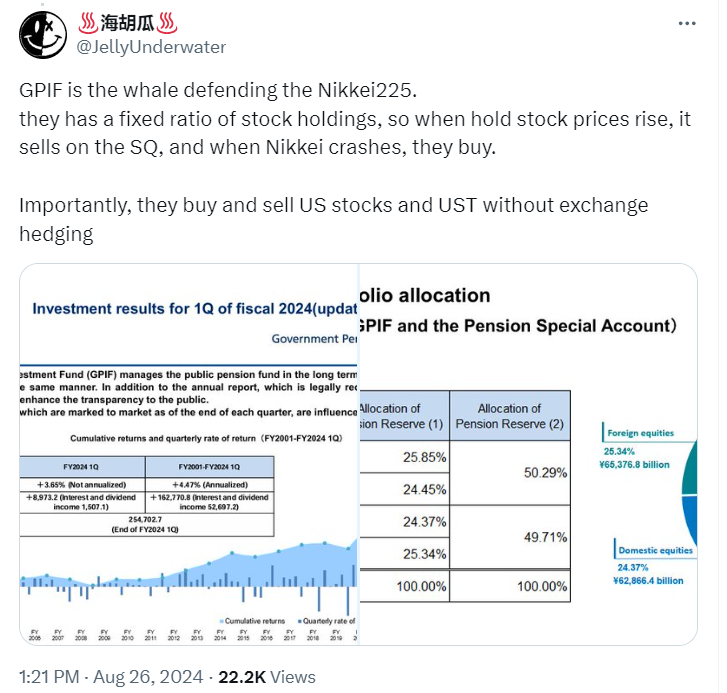

comment I received to this post on X:

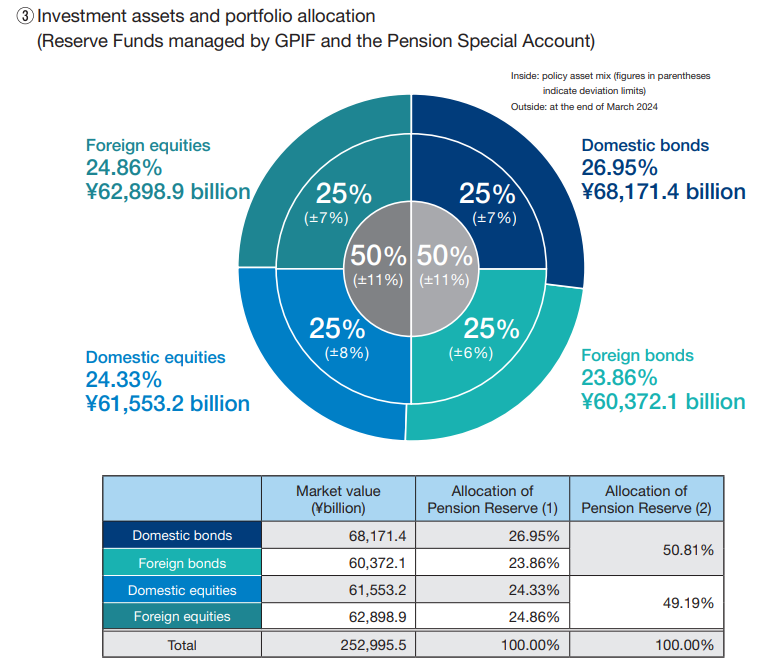

GPIF stands for “Government Pension Investment Fund” of Japan and is literally the largest pension fund in the world with 258 trillion JPY, about 1.8 trillion USD at the current FX rate, of AUM as of the end of June 2024. These are the investment principles upon which Japan’s public pensions are being managed:

Minimal risk and long-term perspective

Diversification by asset class, region, and timeframe

Maximize returns against benchmarks using a mix of active and passive investing

Focus on ESG principles

Pursuing initiatives to promote long-term growth of investee companies and the market as a whole

All of these principles translate into a very simple, yet (so far) efficient portfolio management strategy you can see below:

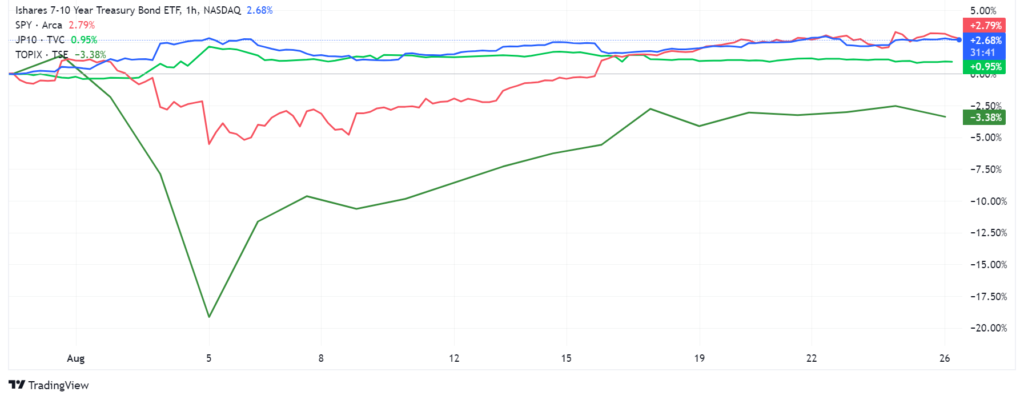

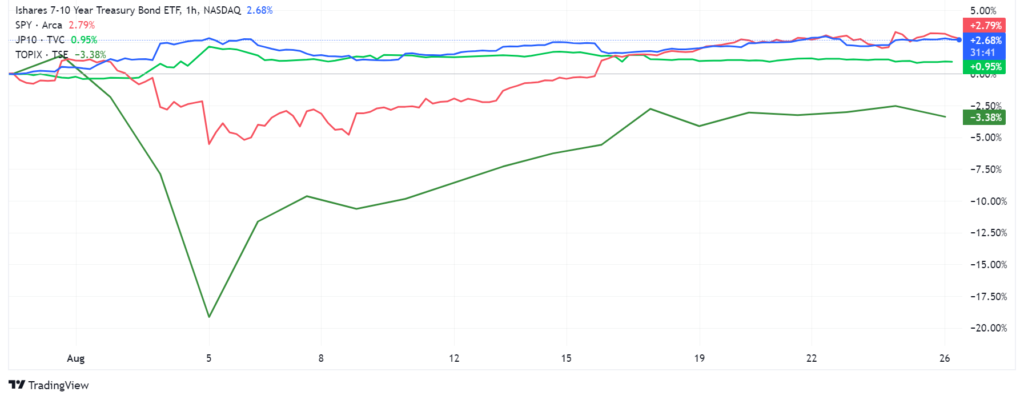

As you can see from the chart below, since BOJ and FOMC policy decisions of the 31st of July that triggered a brutal JPY carry trade unwinding, US Treasuries and JGB appreciated while the TOPIX and SPY, after crashing almost 19% and 6% respectively into the 5th of August, then started an epic recovery.

So what likely happened in those days? Considering GPIF investment principles and strict asset allocation policies, it is very fair to assume that the largest pension fund in the world was actively trading in the market and, with the help of BOJ, FED, and other Central Banks, effectively saved stocks, especially Japanese ones, from an epic collapse. How did they exactly do it?

Considering Japan stocks were crashing on the 5th without a chance to find a bid, the first “help” came from the BOJ that started to buy JGB, pushing yields lower even if they just pretended to stop actively doing so a few days before.

Thanks to BOJ’s actions, the GPIF started to sell JGBs to the BOJ and bid Japanese stocks aggressively, creating a bottom first and then igniting a relief rally into the close because it quickly had to rebalance its portfolio asset allocation. However, this clearly was not enough.

When Europe and US stocks began to trade, the GPIF was such a big seller into the market that market makers’ liquidity quickly dried up to the point many brokers had to pull the plug to avoid a market going “no bid” and begin to free fall due to panic selling.

In this context, the action of FED, ECB, and other central banks, added to the “flight to safety” into government bonds, creating a strong bid for GPIF to sell into, rebalancing this part of its portfolio without a big impact on the market like it happened to JGBs hours before.

- Algorithms clearly picked up this flow and started to front-run it,

bidding hard on Japanese stock futures, hence helping to ease the “mark

to market” losses in that portion of GPIF portfolio further and limiting

their pressure to liquidate US and Europe stocks in the market.

- With the liquidity raised from selling Foreign government bonds and

stocks overnight, on the 6th of August, the GPIF could then burst into

the Japanese stock market guns blazing and bidding whatever was up for

sale, pushing stocks further higher.

- At this point, the momentum was clearly reversing, and all the

market dynamics that pushed the financial markets bubble till now

(momentum algorithms, passive investing flows, volatility shorting,

gamma squeezing, and so on) kicked in, triggering the historical

breakneck rally across the board we all experienced astonished.

- The GPIF still remains a bidder for Japanese stocks and will remain

so till the end of this quarter since, as you observed from the chart

above, its asset allocation is still unbalanced in favor of foreign

bonds, stocks, and domestic JGB versus domestic Japanese stocks. As a

consequence, no one should feel surprised anymore to see a “floor” being

put on Japanese stocks even if the strong JPY appreciation, almost back

to the levels of the 5th of August crash, should have triggered another

significant sell-off in Japanese stocks.

- However, a stronger JPY and the fact that the GPIF reports its AUM

in JPY helps to ease the selling pressure in foreign stocks and bonds,

reason why the rally could continue to stay in place just experiencing

some speed bumps here and there.

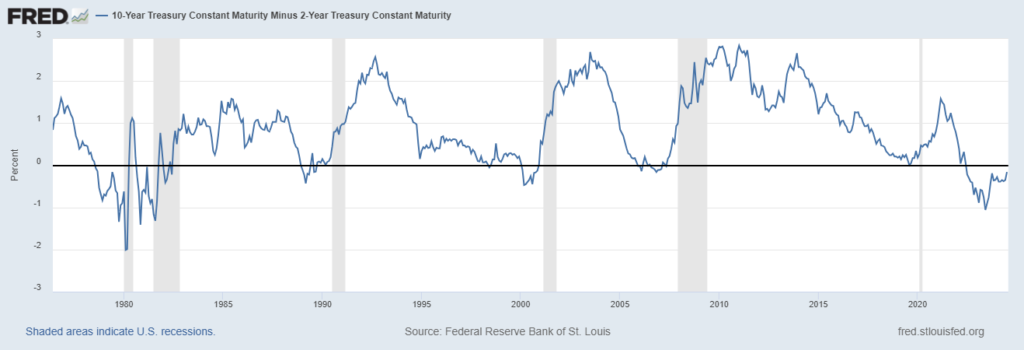

What shall we expect to happen in the future then? If the FED goes forward with its nonsense promise to cut rates (“IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS“) and US treasury yields go further lower, this will actually push the GPIF to sell US Treasuries (that are appreciating in value) to buy more stocks, especially foreign ones if the USD starts depreciating significantly. However, if the BOJ keeps its promise to let JGB yields rise (hence letting JGB value decrease), then the GPIF will have to buy more JGBs while selling stocks, especially foreign ones, since the domestic ones are still currently underweight in its asset allocation. All in all, in theory, this will be a zero-sum game for foreign stocks, keeping the future market impact of the GPIF trading limited.

What happens if the FED cuts rates, reignites inflation, and US Treasury yields start rising again as a consequence? The GPIF will have to sell foreign stocks to buy foreign government bonds, and the same will happen in the domestic part of its portfolio if the JGBs will be finally allowed to rise. Clearly, Central Banks cannot afford the risk of such a big seller of stocks jumping into the market, so likely if this scenario unfolds, they will have to reintroduce yield curve control and eventually QE, making inflation problems even worse and damaging their local economies even more. Clearly, something has to give, and once again the central planners will be asked to decide between defending the current bubble or letting it pop to save their domestic economies and the future of their younger generations. Personally speaking, I do not think they will try to risk the GPIF starting to sell heavily into the stock market, inverting the momentum and triggering a cascade of selling/deleveraging with unforeseen consequences, which is why they will keep maintaining a loose monetary policy, praying for a miracle to rescue them from what’s more and more an inevitable fate.