The SVB bailout was about bailing out the 10 Chinese billionaires who had $13.3 billion in the bank.

— Financelot (@FinanceLancelot) March 28, 2023

The cover story is they're saving us, but in actuality they're buying the wealthy time to get out. https://t.co/oiuAtHknBJ pic.twitter.com/BkaKdYIS2Z

DERECHO TRIBUTARIO Y CONSTITUCIONAL DERECHO Y NUEVAS TECNOLOGIAS ACTUALIDAD JURIDICA Y ECONOMICA MEDIOAMBIENTE

Licencia Creative Commons

Esta obra está bajo una Licencia Creative Commons Atribución-NoComercial-SinDerivadas 4.0 Internacional.

Tuesday, March 28, 2023

TESTIMONIO ANTE EL SENADO USA DEL DIRECTOR DE LA FDIC SOBRE LAS CRISIS BANCARIAS (28-03-2023)

CONTRATO DE LICENCIA DE PATENTE ENTRE EL NIH (USA) Y MODERNA SOBRE VACUNA COVID-19

The U.S. government received hundreds of millions of dollars from vaccine manufacturer Moderna, according to a newly disclosed contract.

Moderna agreed to pay the U.S. National Institutes of Health (NIH) to license spike protein technology that the company used in its COVID-19 vaccine, according to the contract.

For years, Moderna resisted acknowledging the work by government researchers on the spike protein but relented in late 2021. Moderna announced the contract during an earnings call on Feb. 23.

Moderna stated that it provided a “catch-up payment” of $400 million to the National Institute of Allergy and Infectious Diseases (NIAID), which is part of the NIH, under the agreement.

The newly disclosed contract states that Moderna would pay the NIH a “noncreditable, nonrefundable royalty in the amount of Four Hundred Million dollars.”

Portions that would confirm Moderna’s statement that the company would pay “low single digit royalties” on future sales of its COVID-19 vaccines are redacted.

The 34-page contract, which The Epoch Times obtained through a Freedom of Information Act request, has key sections regarding future royalties redacted.

One section starts, “The licensee agrees to pay to the NIAID earned royalties on net sales … as follows.” But the rest of the section is redacted.

The NIH cited as the reason for the redactions an exemption to the act that enables agencies to withhold “trade secrets and commercial or financial information obtained from a person and privileged or confidential.”

Monday, March 27, 2023

ALGUNOS DETALLES SOBRE LA "FUSIÓN" ENTRE CREDIT SUISSE Y UBS (SATYAHIT DAS SOBRE LA CRISIS MUNDIAL)

Before the UBS – CS take-over conditions were finalized, Ms. Keller-Sutter consulted with her US counterpart, Janet Yellen, Secretary of the Treasury.

Here are some facts that emerged since the coerced deal:

- The UBS – CS merger should be finalized by end 2023;

- The Swiss Government (Swiss tax-payer) provides the UBS a loss guarantee of up to CHF 9 billion;

- The Swiss National Bank (SNB) grants UBS and CS a liquidity line of credit – called by its true name, a “bail-out” – of CHF 200 billion, of which the Swiss Government (tax-payer) is guaranteeing any uncovered amount.

- Compare the CHF 200 billion with the CHF 50 billion the SNB offered CS to restructure and sanitize itself – which a day earlier was assessed as being sufficient;

- In the context of the huge “bail-out”, it may be worth mentioning that on 5 March, two weeks ago, the SNB announced one of its biggest losses in recent history, of CHF 132.5 billion;

- The leadership of the merged banks will remain with UBS;

- The volume of the combined UBS/CS-managed assets will be about US$ 5 trillion.

- This banking giant is expected to gradually control 30% to 50% of the Swiss market and will become an important player in the international arena, next to BlackRock (US$ 10 trillion) and Vanguard (US$ 7.2 trillion).

Credit Suisse Takeover in a Black Box

The complexity of the highly interconnected financial and economic system makes predictions about the exact sequence of events in a crisis foolish.

Founder of GMO Jeremy Grantham once noted in October 2008: "I want to emphasize how little I understand all of the intricate workings of the global financial system. I hope that someone else gets it, because I don't. And I have no idea, really, how this will work out. I certainly wish it hadn't happened. It is just so intricate that all I can conclude, by instinct and by reading the history books, is that it will be longer, harder and more complicated than we expect."

The problems currently are within the global banking and financial sector. But financial dislocations feed back into the real economy. There are two primary channels. First, reductions in income and losses of capital affect earnings and savings. Depending on magnitude, it may decrease consumption and investments.

Second, a banking crisis reduces the availability of funding and increases its cost. Small and medium-sized banks play an important role in economies. In the US, banks with less than $250 billion in assets provide roughly 50 percent of all commercial and industrial lending, 60 percent of residential real-estate lending, 80 percent of commercial real-estate lending, and 45 percent of consumer lending. More stringent regulation, tighter lending standards and the likely consolidation in banking will also reduce the supply of funding.

The real-economy effects will intensify any economic slowdown driving new stages of the adjustment.

(...)

The relative geopolitical stability of 2008 is in the past. Current tensions between major powers mean that the likelihood of a co-ordinated response is low. Instead, trade restrictions, sanctions, deglobalisation and containment now dominate discourse. It is difficult to see China rushing to the aid of Western economies and institutions at a time when the US and its allies are keen to restrict the rise of the Middle Kingdom as an economic challenger and great power rival.

The probable response is low rates, government support and generous infusions of money, the policies popularised by former Fed Chairman Alan Greenspan, the 'Maestro' to sycophants. Because it is expedient, easy money is seen as a solution when it is the issue. In essence, it will be another kick of the can down the road although the available tarmac is now much diminished.

The global economy may now be trapped in an easy money-forever cycle. A weak economy or financial crisis forces policymakers to implement expansionary fiscal measures and more monetary expansion. If the economy responds and the financial sector stabilises, then there are attempts to withdraw the stimulus. Higher interest rates slow the economy and trigger financial crises, setting off a new round of the cycle.

If the economy does not respond or external shocks occur, then there is pressure for additional stimuli, as policymakers seek to maintain control. All the while, debt levels continue to increase, making the position ever more intractable.

Economist Ludwig von Mises was pessimistic on the denouement.

"There is no means of avoiding the final collapse of a boom brought about by credit expansion," he wrote. "The alternative is only whether the crisis should come sooner as a result of a voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved."

In a new global financial crisis, where are the dead bodies buried?

The need for funding coincides with a decrease in the amount of new money available. New inflows into private equity have declined by around two-thirds from the 2021 level of around $600 billion. Start-up investments worldwide fell by a third in 2022. The number of funding mega-rounds (fund raisings of $100 million or more) fell by 71 percent. New unicorns (private firms valued at $1 billion plus) fell by 86 percent. It remains to be seen whether VC tourists, who have been amongst the largest losers, return. Most private investments are liquified to realise returns and generate cash, by trade sales or IPOs. With these markets now closed for an unknown period, the ability of investors to free up funds for new investments is constrained.

There is the additional problem of valuations. Between 2021 and 2022, the valuations of private start-ups tumbled by 56 percent. The average value of recently listed tech stocks in America dropped by 63 percent. In 2022, Klarna, a Swedish buy-now-pay-later (also known as point-of-sale (POS) instalment loans) firm, suffered a 87 percent slide in value in one year. In March 2023, payment processing firm Stripe raised more than $6.5 billion implying a valuation which was $50 billion, some 47 percent below its 2021 peak. The cases are not isolated. Lower valuations affect fund-raising options, especially as founders and existing investors would be reluctant to recognise large losses on existing positions. The coincidence of losses on investments and capital calls may lead to a general liquidity contraction for investors, requiring them to undertake forced sales. The position is not confined to the US but also exists in Europe and emerging markets.

A mitigating factor is a record amount of undeployed capital held by managers ($300 billion) and sovereign investors (undisclosed but believed to be, at least, comparable). However, new investments will need to meet stricter criteria with a focus on profitability, cash flows, strategic sectors, and longer holding periods. Since the global financial crisis, higher risk or more complex lending or trading moved into the opaque and less regulated shadow banking system -- non-bank financial institutions which include insurance companies, pension funds, mutual or hedge funds, family offices and speciality financiers. The Bank of International Settlements estimates its size at $227 trillion as at 2021, almost half the size of the global financial sector up from 42 percent in 2008.

Traditional banks are deeply embedded in the shadow banking sector through trading relationships, custody and clearing. Some are minority investors in these off-balance-sheet vehicles as well as arrangers of capital. Banks also provide leverage, often using derivative products or other off-balance sheet structures. Alternatively, they provide direct funding – 'lending to the lender' -- frequently backed by collateral. As the collapse of hedge fund Archegos illustrated, the extent to which it eliminates risk is debatable.

The position is reminiscent of 2000 when the dotcom bubble deflated and also 2008. On both occasions, private funds did not fully recognise or report impairments and were able to take advantage of liquidity fuelled recoveries. It is not clear whether the same will occur this time. An unpleasant revaluation shock in private markets and large write-downs are not impossible.

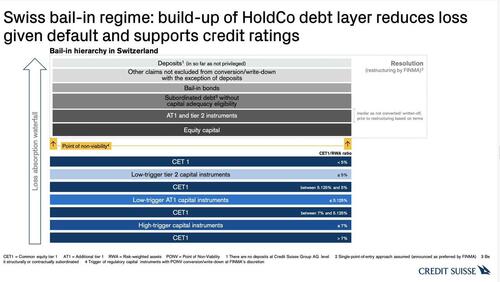

Under the terms of the UBS merger, Swiss Franc 16 billion ($17.3 billion) of Credit Suisse's Additional Tier 1 ("AT1") capital bonds were written off in their entirety. Around Swiss Franc 1 billion ($1.1 billion) of other capital was also written off. Retail and private banking clients globally, especially wealth management investors in Asia, hold significant quantities of complex, highly-engineered derivative-based products. Bought in search of yield during the prolonged period of low rates without a full understanding of the structure and review of the detailed documentation, potential losses could be significant.

After the Credit Suisse AT1 write-offs, the Financial Times published a primer of the structure which might have been useful to investors especially prior to purchase. The extensive use of derivatives to provide exposure to prices and leverage (especially via the ubiquitous carry trade where low-cost funding is used to purchase higher-returning investments) may prove another source of instability. At a minimum, higher volatility across all asset classes will create increased margin requirements triggering cash needs. A true stress test to the central counterparty ("CCP") system designed to reduce credit risk on derivative transactions is possible. Any malfunction would cause a major disruption for financial markets.

Euro-zone banks hold around €3 trillion ($3.2 trillion) of sovereign bonds, around 9 percent of total assets. A dislocation would set off the sovereign doom loop: Rating downgrades of a country result in falls in the value of government bonds held by banks who face calls for additional collateral draining liquidity from markets. The deterioration in a sovereign’s credit quality increases the amount of capital that banks must hold on certain transactions, not only with the sovereign but entities in that jurisdiction. Banks are forced to hedge this risk, usually by purchasing credit insurance on the sovereign or shorting government bonds exacerbating losses. Alternatively, they can use proxies, shorting equity indices, major stocks or the currency spreading losses and volatility into other asset markets. Correlation between major asset classes becomes unstable, especially in a risk-on risk-off trading environment. The increasing financial risk, higher funding costs and reduced market access of banks adversely affected by losses on government bond investments and the reduced ability of the government to provide emergency support sets off a chain reaction of actual losses in the inter-bank markets, requiring further hedging, compounding the spiral. Loss of trading liquidity, uniform rules, similar risk models and herding behaviour, where participants have similar positions and strategies, can prove additional accelerants. Individual Euro-zone nations' lack of independent monetary policy, fiscal capacity, currency flexibility and ability to monetise away debt would re-emerge as policy constraints. Any new debt crisis will expose simmering divisions between debt and inflation-phobic creditor and debtor nations.

The risk of unexpected trading losses and disorderly and uncontrolled liquidation cannot be discounted.

John Kenneth Galbraith in The Great Crash, 1929 described 'bezzle' -- theft where there is an often lengthy period of time between the crime and its discovery. The person robbed continues to feel richer since he does not know as yet of his loss. Bezzle, which increases under benign conditions, is only exposed by changes in the environment. Over the last decade, investors have been 'bezzle-d' by investments offering high returns which did not adequately compensate for the real risk that only emerges much later. If a major financial crisis develops, losses on these bezzle-based investments will impoverish investors. Ç

For the moment, financial markets are holding. But as one analyst of the 1929 crash observed: "Everyone was prepared to hold their ground, but the ground gave way."

Saturday, March 25, 2023

EL CAPITALISMO DESTROZADO (1) (25-06-2020+25-03-2023 (ZERO-COST SOCIETY))

EL CAPITALISMO DESTROZADO (1): Labels: FED, HENRY KAUFMAN, NEW SOVEREIGN, US CAPITALISM HAS BEEN SHATTERED,

WALL STREET Henry Kaufman JUNE 25 2020

The writer, a former senior partner of Salomon Brothers, is president of Henry Kaufman & Co

American capitalism is rapidly disappearing. Its demise has been under way for some time and the economic devastation wrought by the Covid-19 pandemic is the latest blow to our political economy. Adam Smith remains a useful guide to the hallmarks of capitalism. In 1776’s The Wealth of Nations, he argued that humans innately strive for material progress and the best way to get there is through unfettered competition, the division of labour and free trade. Smith wrote that the state should play a limited role in economic affairs. For him, governments should be properly confined to national security, the rule of law — including the protection of private property — and the provision of a few public goods such as education. He also cautioned against sharp class divisions that might idle rich people and exploit workers. “No society can surely be flourishing and happy, of which the far greater part of the members are poor and miserable,” he warned. Smith hoped that whole societies could be enriched through the striving of individual members. This kind of capitalism has been shattered. Free trade is being dismantled as treaties are being abrogated. The free movement of labour is constrained by walls and edicts. Competition enforcement in business and finance is lagging and tardy. The anti-monopoly trustbusting that thrived under US president Theodore Roosevelt is long gone. Concentration of non-financial corporations has increased sharply. Many businesses now enjoy a global reach, allowing them to post non-competitive prices. In financial markets, concentration is even more glaring. Today, a shrinking number of financial conglomerates hold a tight grip on investment management and the underwriting and trading of securities. The enormous underlying conflicts of interest are tolerated by the authorities. In truly competitive economies, those who do well should prosper while those who offer inferior goods and services should fail. Increasingly, that doesn’t happen. Rather, capitalism is being rapidly replaced by statism — a form of political economy in which the state exercises substantial centralised control over social and economic affairs. In the US, the federal government and the Federal Reserve sit atop statism. The government has a vast capacity to tax, borrow and reallocate funds. Federal debt owed to the public currently stands at $20tn and much more can be borrowed. For some time to come, the US dollar will remain the key reserve currency, and overseas investors continue to prefer US government bonds over most other securities. In contrast, the creditworthiness of state and local governments has come under acute pressure because of the coronavirus pandemic, forcing many of them to seek federal help. States and localities will be financially beholden to the federal government, weakening their independence while strengthening the central authority. That is not what the US system of federalism envisions. Historically, the Fed has been viewed as somewhat independent from immediate political interests. But the central bank’s response to the onset of the pandemic-related recession shows that its quasi-independence is quickly evaporating, contributing to the emerging statism. The Fed was helpfully supportive in previous crises. During the second world war, it stabilised yields on government securities. In the 2008 financial crisis, it bailed out prominent financial institutions, engaged in quantitative easing, forced large banks to accept government capital and lowered interest rates sharply. But the Fed’s response to the pandemic is far more open-ended. It is buying not only government bonds but also corporate bonds — including low-quality issues, mortgage obligations, municipal bonds and exchange traded funds. The central bank also is working with the Treasury to get loans to small and medium-sized businesses. Its balance sheet has already swollen by an astonishing $3tn to more than $7tn since the start of this year. And financial markets have come to expect the Fed to intervene in response to any sharp decline in equity prices. Before the pandemic, the Fed had made considerable progress in reducing the size of its balance sheet. But now we can expect an even more significant increase in the size of its intervention as long as there remains no clear resolution to the pandemic, such as a mass-produced vaccine. Markets will probably remain quite skittish as well. With the federal government and the Fed firmly joined at the hip, the transformation of capitalism into statism is gaining momentum, perhaps irreversibly. This is a great departure not only from the vision of the US founders but also, I suspect, it is not the kind of economic system most Americans living today want to leave for future generations.

Copyright The Financial Times Limited 2023. All rights reserved.

Zero-cost society does not detect any mistake …Mistakes are costs…Thursday, March 23, 2023

LA FED Y EL BANCO CENTRAL EUROPEO ( THE MATRIX (EXPLODED),TOM LUONGO 23-03-2023))

The Matrix (Exploded) “There is no route out of the maze. The maze shifts as you move through it, because it is alive.” — VALIS, Philip K. Dick

(Subscribe to the newsletter here)

With the implosion of Silicon Valley Bank the Fed set in motion the next phase of their demolition of the old, corrupt monetary system.

The fake world generated by nearly a generation of zero-cost money is collapsing.

The fallout from this will be immense. But it is also necessary.

FOMC Chair Jerome Powell is wholly aware of this fallout, but, for the first time since The Maestro, Alan Greenspan, left the scene, the FOMC is led by a man who is committed to returning the US to the center of its concerns.

And the globalists who got fat using our money to destroy us are furious.

Now it’s time to begin rebuilding the real world from the ashes of the fake one.

Philip K. Dick would be flabbergasted that someone with power would be the one to tear it down.

The big question now is if enough people will believe this is what’s happening or will they retreat into The Matrix?

This month’s Gold Goats ‘n Guns Investment Newsletter focuses on this struggle and Davos’s next moves to rewrite history with their false vision.

Available now to download through Patreon, this issue of Gold Goats ‘n Guns …

It is a bit more complicated: a real fight & no mockery@TFL1728 has detailed it

— Guillermo Ruiz Zapatero (@ruiz_zapatero) March 24, 2023

With the implosion of SVB the Fed set in motion the next phase of their demolition of the old, corrupt monetary system

The fake world generated by a generation of zero-cost money is collapsing https://t.co/9uq3Oo8tl6

#EUROPA SIN RUMBO DISTINTO DE SU #CRISIS MÁS GRAVE DESDE LA SEGUNDA GUERRA MUNDIAL https://t.co/gJUHTXkSL0

— Guillermo Ruiz Zapatero (@ruiz_zapatero) March 24, 2023

Swiss Defend $17BN AT1 Bond Wipeout In Credit Suisse Deal

Amid the justifiably shocked outcry from Credit Suisse junior debtors, who saw their entire AT1 debt tranche wiped out before the equity was fully impaired, violating every conventional liquidation waterfall, on Thursday Swiss financial regulator Finma has defended its decision to wipe out a huge swath of risky subordinated bonds as part of the Credit Suisse rescue deal even as an army of bondholders is preparing to sue the Swiss government.

Sunday's shocking bail-in, which rendered $17BN of investments worthless, has become one of the most controversial elements of the shotgun marriage between Credit Suisse and its larger rival, UBS, brokered by Swiss authorities. Just hours after the deal was announced, other large market regulators began to distance themselves from the decision, fearful that it would endanger banks’ ability to raise capital in the future.

Meanwhile, enraged bondholders have pledged to sue the Swiss government and Finma over the matter the FT reported.

In its first statement on the deal since the weekend, Finma said on Thursday that all the contractual and legal obligations had been met for it to act unilaterally given the urgency of the situation.

“On Sunday, a solution was found to protect clients, the financial centre and the markets,” said Finma’s chief executive Urban Angehrn. “In this context, it is important that Credit Suisse’s banking business continues to function smoothly and without interruption.”

Speaking to the press on Thursday, Swiss National Bank chair Thomas Jordan argued that the purchase by UBS had been the only option for Credit Suisse, saying that a takeover of the bank by the government and stabilization of it in a process known as resolution would have risked a systemic crisis.

“Resolution in theory is possible under normal circumstances, but we were in an extremely fragile environment with enormous nervousness in financial markets in general,” said Jordan. “Resolution in those circumstances would have triggered a bigger financial crisis, not just in Switzerland but globally.”

“[It] would not have worked to stabilize the situation but, on the contrary, created enormous uncertainty . . . It was clear that we should avoid it if there was any other possibility.”

None of that explains why the decision was taken to preserves CHF3.25BN in value for CS shareholders - who would nominally be subordinated to any bondholders in the capital structure - even as junior creditors were wiped out.

That said, the additional tier 1 (AT1) bonds in question were warned as they contained explicit contractual language that they would be “completely written down in a ‘viability event’ in particular if extraordinary government support is granted”, Finma said. This allowed the regulator to prioritise equity holders ahead of AT1 holders. Furthermore, when AT1s were created as a hybrid debt instrument after the financial crash of 2008, their whole purpose was to give banks greater capital flexibility in the event of crises, and for the bonds to be bailed in in case of need.

Meanwhile, the government's intervention to bail out the combined UBS-CS entity - because if Credit Suisse had gone under, UBS was certainly next - is undisputable: as part of the acquisition deal by UBS, the combined bank will receive CHF9BN of government guarantees and a CHF100bn liquidity lifeline from the SNB. An additional emergency government ordinance issued by Bern on Sunday had further confirmed the power to take decisions over elements of a bank’s capital structure in Swiss law, Finma said.

“[The] instruments in Switzerland are designed in such a way that they are written down or converted into [equity] before the equity capital of the bank concerned is completely used up or written down,” it said, pointing out that the bonds were designed for the use of sophisticated institutional investors because of their risky hybrid nature.

None of that however has helped ease the anger of bondholders who over one weekend saw their entire investment wiped out. Quinn Emanuel Urquhart & Sullivan and Pallas Partners are among the law firms representing bondholders that have pledged to fight the Swiss decision. Quinn hosted a call on Wednesday joined by more than 750 participants.

Partner Richard East told the Financial Times the deal was “a resolution dressed up as a merger” and pointed to statements by the European Central Bank and the Bank of England, which distanced themselves from the Swiss approach.

"You know something has gone wrong when other regulators come and politely point out that in a resolution [they] would have respected ordinary priorities," he said.

“If this is left to stand, how can you trust any debt security issued in Switzerland, or for that matter wider Europe, if governments can just change laws after the fact,” David Tepper, the billionaire founder of Appaloosa Management, told the Financial Times. “Contracts are made to be honored.”

Tepper is among the most successful investors in troubled financial companies, famously making billions of dollars on a 2009 wager that US banks would not be nationalised during the last financial crisis. Appaloosa had bought a range of Credit Suisse’s senior and junior debt as the bank descended into chaos.

Mark Dowding, chief investment officer at RBC BlueBay, which held Credit Suisse AT1 bonds, said Switzerland was “looking more like a banana republic”. His Financial Capital Bond fund is down 12.2 per cent this month.

No matter how the lawsuits turn out, however, one thing is certain: Swiss banking as an industry that thrived and prospered for centuries, is effectively over and nobody will voluntarily either deposit or invest in Swiss banks after this catastrophically bundled government intervention. For the sake of what's left of the Swiss economy, we can only hope that the cheese and chocolate industries are not in need of bailouts.

( INCOME STATEMENT OF SWISS NATIONAL BANK)

#Swiss Defend $17BN #AT1 #Bond #Wipeout In #CreditSuisse #Deal https://t.co/lxXW0akYlg

— Guillermo Ruiz Zapatero (@ruiz_zapatero) March 23, 2023

Swiss #banking as an industry that thrived and prospered for centuries, is effectively over#NEWSOVEREIGN

Wednesday, March 22, 2023

EUROPEAN ELECTRONIC IDENTITY (IDENTIDAD ELECTRÓNICA EUROPEA (I))

I thought it was a chinese communist idea and program

— Guillermo Ruiz Zapatero (@ruiz_zapatero) March 22, 2023

As far as I know any promotion of an #European #electronic #identity #eid (also the EU COVID DIGITAL CERTIFICATE) should be considered in contradiction with the European Charter of Fundamental Rights (article 7)

LA POLITICA DE OBJETIVOS DE UN EURO DIGITAL (EUROGROUP MEETING, (I))

|

While plans to usher in centralized, government-controlled

money are receiving some pushback in the US, the consensus seems to be in

favor of introducing a central bank digital currency (CBDS), i.e., the

digital euro. And now the question is how exactly to proceed, including by determining

strategic objectives. In the eurozone - made up of the 20 (out of 27) EU members that have adopted

the euro - merchants might find themselves under obligation to accept a

future European Central Bank (ECB) digital currency. This is information from a paper that eurozone finance ministers were

expected to discuss on Monday. The obligation proceeds from granting the EU

CBDC the same status as cash, making it a legal tender. The paper says that this course of action would make sure that the digital

euro's network effect and distribution are increased. Another point the paper raises for ministers to debate is if there should be

exemptions, whose goal would be "balancing the principles of contractual

freedom and mandatory acceptance." The ECB is yet to formalize a decision on issuing its CBDC, but this is

expected to happen in the fall, and meanwhile, EU bureaucrats are clearly

busy finalizing the proposal, including technical issues and priorities. Last week, the European Parliamentary Financial Services Forum heard from

Financial Services Commissioner Mairead McGuinness that a bill will be

presented in the near future, and that the ECB is at this point looking into

key design and technical questions before making the decision. But in order for the EU's central bank to make that decision, regulation is

needed, with the European Parliament's and the European Council's

involvement. The proposal is expected to be submitted in the second quarter of 2023, to

establish the bloc's CBDC and regulate it, including around issues like its

legal tender status, privacy and anti-money laundering, financial stability,

distribution and compensation, and the use of the digital euro outside the

euro area, said McGuinness. And earlier, in January, the finance ministers considering this -

collectively known as the "Eurogroup" - noted that going for an EU

CBDC is a political issue that requires political decisions. |

LA POLITICA DE OBJETIVOS DE UN #EURODIGITAL (#EUROGROUP MEETING, (I)) https://t.co/c3MmGZzV0r

— Guillermo Ruiz Zapatero (@ruiz_zapatero) March 22, 2023

Como se ha dicho las Divisas Digitales de los Bancos Centrales están estrechamente vinculadas a la crisis financiera, bancaria y económica en curso

Esta reunión fechada el 13 de marzo

Tuesday, March 21, 2023

EL SEGURO FEDERAL DE DEPÓSITOS, CREDIT SUISSE Y EL DÍA QUE LA FED LIQUIDÓ A EUROPA

So, Credit Suisse is no more. Good riddance? I think this is an open question given the very complicated landscape of the global banking system today. By the time I’m done here I think you’ll have an answer that no one, including me, was expecting.

There’s a lot to cover, so let’s start at the beginning.

In the wake of the “three-fer” take out of Silvergate, Silicon Valley and Signature banks by the ‘market’ I think we have a pretty clear picture of what’s really going on.

This wasn’t a ‘market’ operation. It was a Fed/NY Boys operation and a very successful one.

The Fed (and only the Fed through its proxies) had the motive, means and opportunity to perform the hit job. I wrote a big post for my patrons on March 11th (now made public) going over this.

These Three S’s were all operating as offshore Shadow banks. As Phil Gibson pointed out on his most recent Substack article:

SVB ultimately runs its funding the way Startup funding does:

- A person with $1b comes in and puts $1b into SVB. They go out to a startup and sign a term sheet. This sheet says that the startup will deposit its money in SVB.

- Then SVB goes out and loans that $1b out to another VC. Who ‘invests’ it in another startup, who’s term sheet says they will keep their deposits in SVB.

- So now SVB has take $1b dollars and made it $2b dollars. Without any fed regulation or intervention.

To which I would add the deposits coming back in were then invested in long-dated US Treasuries and marked as ‘hold to maturity.’ This meant they couldn’t be sold. This was a good deal as long as the short-end of the yield curve stayed at the zero-bound, or at least below that of the long-end.

As the Fed raised rates, well, not so much. Too bad, so sad, see you at the Auto Show, SVB.

Rates rising were one thing impairing SVB’s balance sheet but the inversion of the US yield curve didn’t help things either. All it took was a whisper campaign by people with three working brain cells to see the situation for what it was and execute the bank.

Easy peesy, bank run squeezy.

A lot of people have been all over the Fed for this screaming that the Big Banks are rolling up the small banks, but if that were the case why have no other small banks failed?

Why did the Bank Term Funding Program (BTFP) basically allow the Regional banks who had similar holes in their balance sheets to SVB (but who also had risk management officers on staff!) to swap them at par with the Fed at a fixed-term rather than forcing them onto the Walk of Shame to the Discount Window?

Bueller? Frye?

It’s because the BTFP actually saved the regional banks, while simultaneously raising FDIC insurance for insured accounts to infinity and beyond. And while that is a real problem of moral hazard which the Fed and the US will pay for later, it was absolutely the right strategic move from the Fed’s perspective today.

It also created a virtuous cycle for the onshoring of US Treasuries now that the US banking system will need high quality collateral to offset higher savings rates that are inevitable thanks to the Fed taking the smaller banks under its protection.

The ones screaming for the Fed to lower rates and go back to QE are the ones who can’t use the BTFP or they are gold bugs who need to be right that this is it, this is the day they get vindicated for years of being myopic putzes thinking only gold is the answer.

Don’t even get me started on the Bitcoin Maxis.

When, honestly, tboth groups refuse to realize they are simping for the very people who have ensured that gold and bitcoin stay on the margins of the financial system through egregious leverage for more than a decade.

But, I digress.

In effect, the swiftness with which the Fed acted (and crammed an unpalatable solution down Janet Yellen’s throat) actually shores up the regional banks while leaving the Fed free now to continue raising rates and shrinking its balance sheet all while increasing the demand for US Treasuries during a period of intense de-dollarization.

The price? A few extra billions of rent was paid off to the thieves. But, that’s it. The spigot has been closed, the stopcock broken off and the valve filled with molten lead. Gone. Done.

Well, except a few here and there via swap lines to make it look like they aren’t heartless.

But please note the ECB got the same terms on a USD/Euro swap that the Regional Banks get from the Fed. We didn’t see Powell announce an emergency rate cut or anything like that.

If anyone did the bank Walk of Shame it was the ECB.

The point of my opening argument is that the Fed did exactly what it was chartered to do here…. protect the US banking system. And it did that while paying lip service to coordinating central bank policy to keep US dollar funding markets liquid, which is also part of its job, as long as it is in service of its primary job, protecting US banks.

And, as I’ve argued over and over, while there are still massive holes in the global financial system because there aren’t enough dollars to go around, the Fed is now in control of who gets those dollars. Watching who does and who doesn’t get preferential treatment is now the key to understanding what happens next.

You, Me and the FDIC

Right up until his death, the Calvinist OG of the Austrian Economic Sewing Circle, Dr. Gary North, wrote about FDIC and its importance in ending the Great Depression. He wrote volumes on the subject. North understood better than nearly everyone that fractional reserve banking is a confidence game.

And FDIC in the US is the bedrock on which confidence in the post-Great Depression US Empire was built. Well, okay, FDIC, the Marshall Plan, LIBOR, and the whole Eurodollar global reserve fantasy world if you want to be pedantic.

Whether you agree with fractional reserve banking or not is irrelevant. It exists, is the paradigm on which our banking system operates, and has very predictable fault lines within it guaranteeing bank runs at some point.

Milton Friedman and his disciples are wrong about what started and stopped the Great Depression. Capital flight out of Europe because of a sovereign debt crisis sent US equity markets to new highs thanks to a strong US dollar, per Martin Armstrong’s analysis, and North was right that FDIC was the only thing that curbed the demand to hoard dollars under mattresses and put them back to work in the banking system.

So, read his 2019 missive explaining the situation in the aftermath of the Repo Crisis and think through the massive liquidity injection by Keynesians in our government in “response” to COVID-19, which FOMC Chair Jerome Powell argued against, and you’ll see echoes of where we are today.

Under today’s circumstances {2019}, the money supply will not shrink. The money supply is based on how much debt the Federal Reserve System has in its reserves: the monetary base. {In 2023, the Fed is shrinking its reserves} The fact that depositor A in busted Bank A has lost his money does not shrink the money supply. Another depositor, who was paid by borrower B (e.g., a mortgage borrower) at Bank A, still has his deposit in Bank B. The banking system does not lose money. But doubts spread about the economy. People start moving their portfolios toward near-cash assets. They start selling stocks so that they can buy Treasury bills or T-bonds.

To North’s point about selling stocks to buy US Treasuries, today is different because there is a massive stock of money in the Reverse Repo Facility but the dynamic is the same. As the Fed raises rates money is flowing out of where it is into Money Markets and variable rate US Treasuries, as Ted Oakley suggested in my last podcast with him.

People are getting to near-cash assets as the Fed raised rates.

This has been going on all year {2019}. The 90-day T-bill rate is under 2%. It fell before the Federal Reserve announced its reduction in the federal funds overnight market. The FED has trailed T-bill rate all year. The FED gets credit for lowering rates, but this has been an illusion in 2008. The FED has been playing catch-up with the T-bill rate. It announces what T-bills have already achieved: lower rates.

The Fed did the opposite of what the market told it to do in 2019. Powell raised rates fast. He did this to “break something” as Danielle Dimartino Booth said all through 2022.

This is why the “Pivot” crowd is crowing today that the Fed is headed back to the zero-bound and will restart QE. But they are wrong.

I read everything North wrote during the bailouts and advent of QE during the 2008 Financial Crisis as part of my real education. I know he would be part of the pivot crowd because he had no faith in the Fed. And rightly so. None of us did in 2019 and should be skeptical of it in 2023.

But North also understood incentives. He understood that if the Fed broke something the first thing it would do is lobby for raising FDIC limits.

He argued then, rightly so, that FDIC expansion was the right step then and eventually it would go to infinity. Fine, no argument there. Nothing is off the table when the Fed is out to protect the US banks.

And right on schedule, when a few particular regional banks of dubious character (and allegiance) blew up, Powell gets Yellen to agree to unlimited FDIC insurance for insured accounts (not, crucially important here, uninsured accounts) while also filling the holes on the Regional Banks’ balance sheets.

This was the main thing Powell did to put the US banking system in a superior position to all the other banking systems. We have the ability to absorb these depositor losses and the political incentives line up to ensure that occurs, from both sides of the populist political aisles.

Even Elizabeth Warren can’t complain about what the Fed did here.

But North also was right about Bernanke’s sterilization of QE through another Fed manipulation of capital flow, Interest on Excess Reserves (IOER). He argued, rightly in 2009, that IOER would be stagflationary, creating the financialized world we have today but where the real economy would suffer from constraints having to compete for capital with any idiotic idea out there because money was free.

The slow growth era of the Coordinated Central Bank Policy Era was instrumental in hollowing out what was left of Main Street.

Et Voila, 2023.

And that brings me, finally, to Credit Suisse.

Burning Down the Haus

One of my favorite heuristics in analyzing big moments in history is to look at who is saying nothing and who is bitching.

Whoever is bitching is vulnerable and getting the shaft, especially if they are aligned with certain groups of people, in this case the devil we all know, The Davos Crowd.

Whoever is saying nothing is winning. Notice that Jamie Dimon isn’t saying anything other than helping to shore up First Republic Bank with JPM’s own capital? As Luke Gromen would say, “Signpost!”

So, here’s your timeline of events leading up to this weekend.

- The US/EU force Russia’s hand into invading Ukraine in Feb. 2022

- The US/EU try to destroy Russia setting off a liquidity spiral of insane commodity prices

- The Fed raises rates to combat inflation while having decoupled US banks mostly from Europe

- SOFR overtakes the Eurodollar as the US dollar funding vehicle of choice.

- The Swiss gov’t gives up their centuries old neutrality by backing Ukraine publicly

- The Swiss President is clearly a compromised figure, undermining Swiss sovereignty for the Great Reset (See my Podcasts with Pascal Najadi on this. Episodes #122 and #132)

- Because of this Switzerland starts seeing capital outflow b/c it’s no longer neutral

- During the takeover of the UK last summer, Credit Suisse comes under attack, forcing the Fed to shore it up through swap lines to the SNB.

- The Fed keeps raising rates forcing the ECB to follow.

- Eurodollar liquidity collapses, the BoJ begins giving up Yield Curve Control.

- Russia keeps grinding out the Ukrainian Army in the Donbass

- Once the Fed breaks the Three S’s Davos counters by pulling their liquidity from CS.

- The run on CS intensifies forcing the SNB and UBS into action.

- They screw the AT1/CoCo bondholders.

The question raised by #14 is why? Why not let them get their shekels?

This is a clear assault on the vestiges of Swiss sovereignty and the credibility of its banking system, on which the entire country’s reputation is based. To think that they wouldn’t bend the rules on who gets paid first in this situation is hopelessly naïve.

So, this morning everyone in Europe is furious over the forced merger of UBS and Credit Suisse. For the record I put out what I thought strategically about Credit Suisse and why it would never be allowed to go under:

The main sticking point for UBS’s buyout of Credit Suisse is the 100% write-down of the $17B in “Contingently Convertible” (CoCo) or AT1 bonds, while shareholders of Credit Suisse were put in front of them, getting a few pennies for their previous investments.

Here’s the thing. Everyone was wiped out in the Credit Suisse debacle. I believe the point of the attack was to limit the Swiss National Bank’s ability to conduct monetary policy by impairing its $139 billion equity portfolio as a way to raise cash and/or supply US stocks to European investors seeking a safe haven from any fallout in Europe.

Moreover, these AT1 or CoCo bonds are effectively permanent bonds, paying out in perpetuity as long as the issuing bank stays solvent. If you take out the bank then they get converted to equity. Knowing that CS was too important to be allowed to fail, I’m betting someone was expecting to force the terms of the bailout.

And the Swiss just said, “Um. No. Sue us.”

Oh but you can’t because there were covenants in both UBS and Credit Suisse AT1 bonds which allowed for shareholders to be put in front of bondholders. Again from Zerohedge:

As Bloomberg notes, the clauses that led to the bonds being marked to zero aren’t common. Only the AT1 bonds of Credit Suisse and UBS Group AG have language in their terms that allows for a permanent write-down and most other banks in Europe and the UK have more protections, according to Jeroen Julius, a credit analyst at Bloomberg Intelligence.

Now, where have I heard about perpetual bonds before? Oh right, from George Soros who wants Europe to default on all of its sovereign debt, wipe out investors, and hand them perpetual bonds as compensation.

Let’s put this all together.

UBS bought CS for $3.2 billion. There were $17 billion in Credit Suisse CoCos. As of last Friday’s close UBS’s market cap was $56.5 billion. That would have made the CoCo holders the biggest ownership group in UBS.

And yet, no one is talking about this.

Does anyone really think UBS would buy Credit Suisse and hand over ownership of their bank at the same time? No. There would be no deal if that were the case.

And what did the UBS term sheet for merging with CS do? Not only did it block the effective takeover of Credit Suisse by the CoCo bondholders who likely were behind the attacks on it in the first place, it impaired the idea of CoCo or perpetual bonds in the minds of investors ensuring that this form of hostile takeover doesn’t happen in the future.

This was the only outcome where both the SNB and the Fed maintained any semblance of control over Swiss monetary policy. Merge UBS with Credit Suisse and write the CoCo bonds to zero, freezing out a hostile takeover attempt.

If I don’t hear about George Soros having a heart attack in the next 24 hours I will be honestly shocked, because this was clearly something he would have tried to orchestrate.

Here’s the money shot folks from Zerohedge (finally getting something right in all of this):

Junior creditors should bear losses only after equity holders have been fully wiped out, according to a joint statement from the Single Resolution Board, the European Banking Authority and the ECB Banking Supervision, who apparently were not consulted on Sunday during the whirlwind decisions that preserved some equity value at CS while wiping out its entire AT1 tranche.

Now why do you think the ECB and European banking authorities weren’t consulted on this?

Because this is the key to destroying the capital structure of what’s left of the European banks while also hamstringing the SNB.

These AT1 bonds, all $275 billion of them across Europe (okay $258 billion now), were the financial time bombs meant to go off and wipe out the current owners of these banks and transfer them to those who would consolidate power in Europe.

Now, bring back in FDIC. The US has one monolithic FDIC system. Europe doesn’t. There are $100,000 insurance programs in individual countries, but no EU program to protect savers. So, think this through. When the banking crisis evolves in Europe the countries will be bailing out their depositors blowing gaping holes in their budgets, which EU rules for many of them will preclude, especially if they are running deficits.

The AT1 bondholders will be gaining control over their banks. The people will be thrown out into the streets.

Depositors over $100,000 will be wiped out. The same fears of small businesses being frozen out of their accounts to make payroll that forced Yellen’s hand to go big on FDIC for deposits will play out across Europe.

The entire European commercial banking system will cease to function. It leaves the door open for a massive EU led bailout during the height of the crisis to do what Soros has been demanding they do:

- Have the ECB buy all the outstanding Eurozone debt

- Convert it all to perpetual bonds, in effect issue new CoCo bonds for the entire Eurozone.

- This is a default on all the sovereign debt and wipes the slate clean

- This is a default on all the sovereign debt and wipes the slate clean

- Then convert all existing euros to digital euros overnight

- Minority Report with more Germans.

And the people who created the problem will be the ones who implement it because well, they now own all the banks.

But, here’s the rub. It is why Europe is furious this morning despite anything that comes out of Christine Lagarde’s pie hole, sorry broccoli hole.

The CoCo bond market is now frozen, the bonds are getting gutted. These are some of the most important bits of Tier I capital under Basel III for European banks. Ooops!

Goldman is saying there is now risk of “permanent destruction to demand for AT1 bonds.” You don’t say Goldman?

The entire idea of CoCo bonds has been undermined by the Swiss and, I think, by extension, the Fed.

On two major fronts, limited insurance for bank deposits and terminally impaired capital structures for European banks, the Fed just positioned the US to be the recipient of major capital inflows as all of the interest rate and credit risk is transferred back to Europe.

This morning I consulted with Dr. North’s Ghost:

Join my Patreon if you don’t want to be converted

Published by Tom Luongo

Publisher of the Gold Goats n Guns. Ruminations on Geopolitics, Markets and Goats. View all posts by Tom Luongo

LA GUERRA DEL DOLAR ESTÁ TERMINADA (TOM LUONGO (III): EL MOSQUITO O EL PARABRISAS

Editor Note: I've made this post public to help support my public blog post from 3/21/2023

You had to think that FTX wasn't the only cog in that machine.

Also, during that time, Dexter and I both noticed that all through the bear market collapse of Bitcoin it was one stablecoin failure after another which caused each major downdraft, crashing bitcoin through major support level after major support level.

Finally, after FTX, with all of the leverage gone, Bitcoin found a floor at $16k, the FUD was running high that it was going to $5k. USD Tether was about to implode, GBTC has been beaten with the NAV ugly stick (Still trading at 40% below NAV), etc.

But, as always, when the headlines are that bearish and everyone is jumping out of windows, that's likely your bottom.

And it was.

In the initial flush of what happened I came quickly to the conclusion that FTX was a Fed/NY Boys hit job and turned out to be right on the money with it. Dexter was correct in his assessment of what FTX was, "a Ponzi Hoover," designed to hoover up the cash and assets of the 'crypto' space and use that to build a competitor to the US dollar payment systems controlled by the Fed and the NY banks.

FTX was close to achieving escape velocity with its system and therefore had to be taken down. Now, Silvergate was another company on the same path as FTX, having its SEN payment system capable of settling transactions 24/7/365 in real time go live with its stablecoin as the liquidity token.

Between FTX and Silvergate the Fed's own project, FedNow, would have real competition and more synthetic dollars would flood the world.

For once they even mostly get the "Who?" right. They try to pin this on JP Morgan Chase CEO Jamie Dimon, digging up that Dimon encouraged people to pull their money from SVB.

Of course, Jamie, who has suddenly emerged as a key figure in the Jeff Epstein scandal alongside Jes Staley, knows this, and would be delighted with an outcome that kills two birds with one stone: take his name off the front pages and also make JPMorgan even bigger. Actually three birds: remember it was JPM that started that "Not QE" Fed liquidity injection in Sept 2019 when the bank "suddenly" found itself reserve constrained. We doubt that JPM would mind greatly if Powell ended his rate hikes and eased/launched QE as a result of a bank crisis, a bank crisis that Jamie helped precipitate.

And while we wait to see if Dimon's participation in the Epstein scandal will now fade from media coverage, and whether Powell will launch QE, we know one thing for sure: JPM was a clear and immediate benefactor of SIVB's collapse because in a day when everything crashed, JPM stock was one of the handful that were up.

Let's review a few things that I mention all the time.

- FOMC Chair Jerome Powell has no problem with Bitcoin

- Powell, however, hates stablecoins

- Stablecoins are nothing but Eurodollars that exist in 'cyberspace'

- They are synthetic US dollars and, as such, are really artificial claims to dollars

- Again, not dollars, just claims to dollars no different than Eurodollars

What many of the Tylers at Zerohedge refuse to accept is that the Fed is at war with Eurodollars. Maybe they are finally somewhat convinced that I'm right about this but are still in denial about how the Fed extricates itself from the Offshore Dollar Markets without breaking the whole system.

It's a fair position to take, frankly. I don't claim to know if they can or cannot pull this off. But, what I can say is that they sure are acting like they can.

Now, back to SVB and Silvergate. SVB's balance sheet was stuffed to the gills with low-yielding long-dated USTs, the assets of choice for a stablecoin like USDC. They also held a whole lotta Mortgage-Backed Securities (MBSs) to get yield.

With a stablecoin, you don't actually care much about yield, only that you can get access to 'real dollars' at nearly no cost. In fact, the lower the cost the easier it is to 'print reserves' if need be through leverage and carry trades.

This is a perfect example of what I have been saying for nearly two years, that the Fed is at war with Eurodollars, both 'real world' and 'crypto.'

This bank run was absolutely another hit job on 'crypto' but not Bitcoin. Dimon is crowing this morning. It's having real repercussions around the banking community. There are going to be a few more bank runs here as well as a lot of negative headlines as payrolls are missed, layoffs occur, etc.

That's the bad news. Every 'Pivot' monkey on Twitter will be screaming that the Fed has to now. They are going back to the zero-bound. This is it! The world is breaking. The dollar is toast.

And hey do this to feather their own nests, confirm their biases, and feed their pathetic egos.

Silvergate and Silicon Valley Bank were two peas in a Eurodollar pod. One was the architecture and the other the money funnel for a competing system to end-run the Fed's tight monetary policy. These schemes were all birthed during the Yellen/Bernanke era of ZIRP and NIRP.

They were meant to be the bridge projects to build a global CBDC network which the market would beg for, because of the lure of 'yield farming' in a world where the central banks were 'trapped at the zero bound.'

My latest public blog post goes over this idea of carrots and sticks to move from one system to the next, from the petrodollar to the asset-backed BRIICSS settlement system on the horizon or from LIBOR to SOFR.

These 'crypto' projects were sold to us as the new carrot to help Davos and the old money return us to serfdom through our own greed and desperation after fifteen years of negative nominal returns.

This whole 'crypto' stablecoin thing was nothing more than an attempt to truly co-op Bitcoin (and proof-of-work) which is truly tokenizing previous human work to issue a new bearer-asset form. It is, as Christine Lagarde called it, "an escape hatch," which we will use if it's available.

The Fed, in trying to protect itself here, is actually helping Bitcoin out here by removing these projects from the landscape and calling bullshit on all of them.

Since FTX blew up, as Chris Sullivan pointed out in Episode #131 of the GGnG Podcast, liquidity in Bitcoin went to ground (back on chain) and off the exchanges. This is the reaction of a healthy market not a dysfunctional one.

The dysfunction was in the exchanges, not the protocol nor the asset.

To close, the blow up of SVB is the next formal attack on this system. It will be mostly contained. The headlines will make you want to vomit and pull your money from the US banking system. This is Davos' revenge through the media. They know that humans don't trade these markets anymore, only headline-scanning computers.

But, like with Bitcoin going to ground after FTX, the algorithms will stabilize the minute there isn't any systemic risk to the system.

One last point as I brought up in a Twitter thread yesterday before getting a lot of facts.

Let's note a couple of things:

- Powell sending the rate markets into panic on his Senate testimony

- "We don't care about your fiscal mismanagement in setting monetary policy, Senator Lummis."

- Big blow ups in a 50 bps FFR rate hike later this month.

- Davos trying to "Nuts and Sluts" Jamie Dimon tying him to Jeffrey Epstein

- A ridiculous legal ruling against Dimon/JPM in an Obama-controlled court

- This screams the Soros hit-job on Italy's Matteo Salvini over migrant boats.

- Kuroda finally stepping down as head of the Bank of Japan

- As I discussed in recent Market Reports, I believe the BoJ is about to shift policy away from Yield Curve Control.

- Tucker Carlson's expose of the fraud of 1/6 and the Committee's Witch Hunt.

- Continued attacks on Credit Suisse who the Fed bailed out last summer.

We'll really know if these things are the case if the Fed holds onto raising rates by at least 25 bps. If they go 50 bps, it's popcorn time.

FDIC Insurance, Credit Suisse and the Day the Fed Killed Europe https://t.co/MQLmtR1wna

— Tom Luongo (Head Sneetch) (@TFL1728) March 21, 2023

As Ive been saying, the #US move to raise #insurance put #ECB at a major disadvantage. The fact that he's saying they need to do this means they cant act quickly. The stage is set for massive #capitalflight #from #Europe to US as #CS skeletons will emerge from the closet https://t.co/LlHRCt1Qhw

— Guillermo Ruiz Zapatero (@ruiz_zapatero) March 21, 2023