5) MORE TREASURY DUMPING BY CHINA

— Balaji (@balajis) July 22, 2024

Next, did you know that China (the single largest foreign buyer of US Treasuries) has been dumping[5] US paper at an accelerating clip?

This is a bit technical, but China is an “outside investor” in the US kind of like a new venture capitalist… pic.twitter.com/1XTyGuSToA

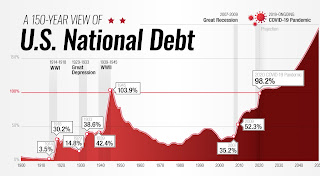

9) PEACETIME DEBT APPROACHING WW2

— Balaji (@balajis) July 22, 2024

All right, but what about the US military? Can’t it ultimately go to war to protect the dollar? Well, that’s a much longer conversation, but see the graph[9] below. Today the US is ostensibly in “peacetime." And yet it has comparable debt to WW2:… pic.twitter.com/Q6PMQg8Y6T

That $175.3T lines up with the ~$200T number that Druckenmiller[5] has been using for the all-in liabilities of the US government when you take everything into account.

And of course, at this point we are in monopoly money territory, because:

a) The entire fedguv only collected ~$2T last year

b) That number is itself juiced by deficit spending

c) The dollar is down ~25% in real terms since 2020

d) And the "177T" in asset value plummets if liquidated

e) ...or if there is a financial crisis, or both

So, that 175T debt is unpayable.

The US government doesn't have nearly enough to pay for what it owes. It's made promises to everyone, from allies to retirees, that it simply can't keep. To hang on to power amidst that web of broken obligations, it is going to get nasty on a level beyond which most can really comprehend.

THE DOLLAR IS BECOMING LESS ESSENTIAL

In short: I really haven’t even gotten started. There are many more graphs I could show, many more videos from investors around the world from bonds to real estate to tech who're seeing what's happening.

But if you’re intellectually honest, the dollar’s position is rapidly eroding. It simply isn’t the indispensable asset it was.

To summarize:

a) China doesn’t need the dollar to trade, they’re using CNY instead of USD.

b) BRICS doesn’t need the dollar to save, they’re buying gold instead of US bonds.

c) Russia doesn’t need the dollar to live, they’re the #4 economy after being shut out of the US economy.

d) Yet the US needs as much of the world as possible to accept the dollar, as it’s borrowing at levels beyond COVID, beyond WW2, beyond any empire in history.

So: what comes next? I have some ideas, but first we need to align on what’s happening.

REFERENCES

[1]: Fed's own blog admits 2023 saw more emergency lending than 2008: fredblog.stlouisfed.org/2023/04/the-le

[2]: Borrowing after COVID approaches borrowing during COVID, but at much higher rates (5% vs 0%). fxstreet.com/analysis/fisca

[3a]: Interest payments soar to exceed defense: x.com/YahooFinance/s

[3b]: Interest payments exceed everything! pgpf.org/blog/2024/07/a

[4a]: The dollar has lost at least 25% of its value in four years. truflation.com/dashboard?feed

[4b]: And it might be much more than 25%, if the 18% loss of value in one year is right. x.com/LHSummers/stat

[5]: China is dumping US Treasuries. michelsanti.fr/en/china/china [6]: BRICS countries are buying gold. x.com/PopescuCo/stat

[7a]: China is the world's #1 trade partner. economist.com/briefing/2021/

[7b]: China is dedollarizing on its own trade corridors. x.com/StubbornFacts/

[8]: Russia flips Japan in 2023 to become #4 GDP by PPP. See here (finshots.in/archive/russia) and here for the raw data (data.worldbank.org/indicator/NY.G)

[9]: 150 Years of US Debt. See here (visualcapitalist.com/wp-content/upl) and also here: visualcapitalist.com/timeline-150-y

[10]: Feb 2024 Treasury report admitting to $175.3T of debt, buried on page 193 rather than put on the cover: fiscal.treasury.gov/files/reports-

[11]: Oh, and here's one more debt infographic by the Petersen Foundation: pgpf.org/blog/2024/07/a

#THEMEANING OF MEANING IS #RELATIONSHIP... https://t.co/sHvflJU5uq pic.twitter.com/k2cC9Qacxd

— Guillermo Ruiz Zapatero (@ruiz_zapatero) July 23, 2024

#wendellberryhttps://t.co/lIqV2VdbNT

— Guillermo Ruiz Zapatero (@ruiz_zapatero) January 3, 2024

Our most serious problem, perhaps, is that we have become a #nationoffantasists …

In #war the victimization of humans is directly intentional and in #industry it is “accepted” as a “trade-off.” pic.twitter.com/hP4sIXnUNS

No comments:

Post a Comment