UBS Q1-24 RESULTS REVIEW - THE “LA LA LAND” BANK - JustDario: “UBS swings back to profit and smashes earnings expectations for the first quarter”, was the CNBC headline shortly after #UBS Q1-24 results announcement. But what about all other MSM? Everyone, of course, is jumping on the same celebratory bandwagon. I wonder how many of these people influencing markets and sentiment...

#UBS is recognizing the gross revenues from #CS business EXCLUDING any negative effect from marking to market the assets acquired to their market value.

As if this wasn’t enough of a joke by itself, as a cherry on top of the cake #UBS is also excluding losses from their investment in SIX Group (the Swiss Stocks Exchange)

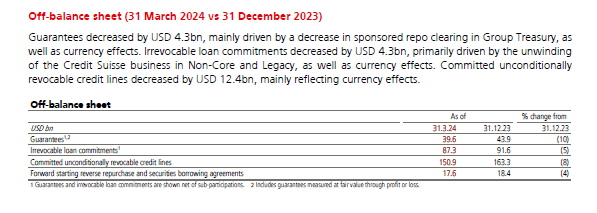

Ah, one more thing, #UBS also has 295bn$ of OFF-BALANCE SHEET assets

If we include this amount in our RWA calculation the result is ~46.5% assessment on their completely unsecured risk positions. Yes, that’s quite a lot of stretching.

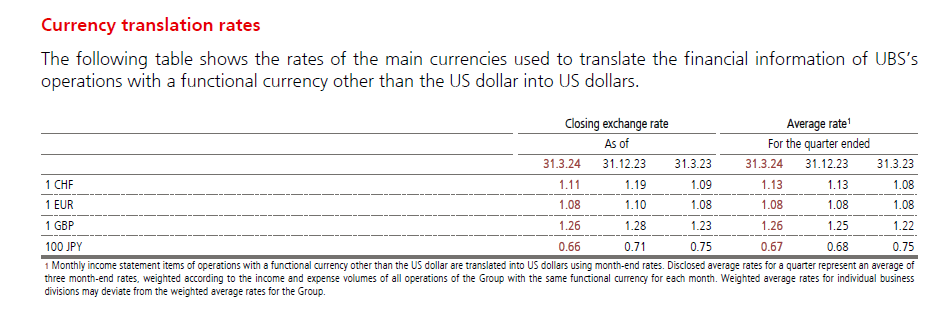

– After we saw #HSBC doing that last week in “IS HSBC CEO “UNEXPECTEDLY” LEAVING BECAUSE THE BANK WON’T BE ABLE TO HIDE ITS PROBLEMS FOR MUCH LONGER?”, completely defying the laws of financial markets gravity even #UBS did not include any FX impact whatsoever in their Q1-24 results. No further comments are needed here.

– What about Expected Credit Losses (ECL)? As you can see, #UBS is very optimistic about the future of the US and Swiss economies to the point that not only they IMPROVED their baseline expectations (picture 1), but they also completely removed a “Global Crisis” scenario from the projections in Q1-24 (picture 2). All this resulted in a meager 106m$ put aside for ECL and no, I am not joking.

– Why is the Swiss Central Bank suddenly asking #UBS to increase their capital by ~25bn$ as per the “Swiss central bank calls for more capital rules after Credit Suisse saga” quickly forgotten “breaking news” from 2 weeks ago?

Reason 1: #UBS has a chronic hole in their brokerage business

...

Reason 2: #CS’s “Negative Goodwill” of 27.7bn$ that was booked 2 quarters ago after applying its own “mark to market” to #CS assets marking a “historical” profit for a bank might not have been that positive after all (negative goodwill increases the revenues and assets in financial statements). What happens if those assets are worth 27.7bn$ less and #UBS’s CET1 capital instead of 78.7bn$ is 51bn$? Well… that will shrink their CET1 capital to 9.3%. What is the absolute minimum capital requirement for a G-SIB bank like #UBS (without considering increments because of the size)? 10%. There you go.

So basically #UBS is already under-capitalized because of #CS real asset values, still assuming their “La La Land” mark to markets on the rest of their books and the Swiss Regulator clearly knows it. Furthermore, this even excludes the “hole” we discovered in the #UBS brokerage business. I bet the regulator is aware of it too, hence the sudden “urgency” that is scaring off the bank’s management. What if we combine the 2? Well… #UBS’s CET1 will fall below the 8% absolute minimum requirement in the blink of an eye.

As I write, #UBS shares are trading up 8% celebrating the great Q1-24 results, I wonder if you agree with that now that you have read this article.

...

Trust me, no one would be selling you something if they thought they would be getting a good deal out of it first. This is why I find it very hilarious to see investors buying shares of companies where their management consistently exercises their stock options and then liquidates the stocks shortly after in the market. I find it even more hilarious to see investors buying stocks of companies that consistently perform share buybacks in the market when prices are expensive, not the opposite. Isn’t this counterintuitive? With all the insider information they have, the management should be buying back stocks of their own company when these are cheap, not the opposite, right? Well… but when the stock is at the top, it’s the best time to cash out their bonuses paid in shares…

Feel free to disagree with me, but we’ve come to a point where investors are acting in the market against their own interests without realizing how their actions are counterintuitive in their nature. We’ve even seen extremes equivalent to investors buying a used car that was being set on fire in the parking lot. Why? Because they knew there is a buyer lining up right behind them that is willing to buy that too so if they bid first they could then resell it at a higher price, making a profit in the process.

How could all of this be sustainable and end well?

Read the comment below (sniper 🎯 from @OptionsTaker ) then close your eyes and picture the laughs at $UBS management offices knowing 🐑🐑investors swallowed bite hook and line 🎣 and are now stampeding to buy the stock currently up 9.56% https://t.co/Aq4T7tkwHa pic.twitter.com/t1eiJxut5W

— JustDario 🏊♂️ (@DarioCpx) May 7, 2024

LA #REVISIÓN DE LOS #RESULTADOS DE #UBS, Q1-24 RESULTS REVIEW - JustDario https://t.co/lCsl3Xw0l4

— Guillermo Ruiz Zapatero (@ruiz_zapatero) May 8, 2024

As I write, #UBS shares are trading up 8% celebrating the great Q1-24 results, I wonder if you agree with that now that you have read this article@DarioCpx pic.twitter.com/WvBeR2i8l3

No comments:

Post a Comment